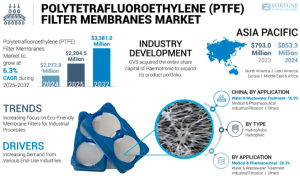

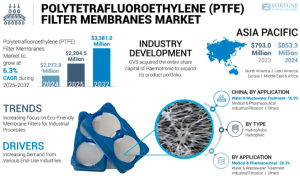

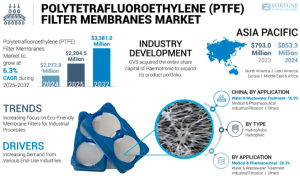

According to Fortune Business Insights, The global polytetrafluoroethylene (PTFE) filter membranes market size was valued at USD 2,073.8 million in 2024. The market is projected to grow from USD 2,204.5 million in 2025 to USD 3,381.0 million by 2032, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the polytetrafluoroethylene (PTFE) filter membranes market with a market share of 41.15% in 2024.

Polytetrafluoroethylene (PTFE) filter membranes are synthetic membranes used for air and liquid filtration. PTFE is classified into hydrophobic & hydrophilic type that repels water and other liquids, making it an excellent choice for filtering gases and liquids. Polytetrafluoroethylene filter membranes ****are often used in applications that require high chemical resistance, high temperatures, or high purity. They are commonly used in the pharmaceutical, food and beverage, and chemical industries.

LIST OF KEY COMPANIES PROFILED:

- HYUNDAI MICRO Co., Ltd. (South Korea)

- Hangzhou IPRO Membrane Technology Co., Ltd (China)

- Suzhou Unique New Material Science & Technology Co., Ltd. (China)

- Hangzhou Cobetter Filtration Equipment Co.Ltd (China)

- GVS S.p.A. (Italy)

- General Electric (U.S.)

- Pall Corporation. (U.S.)

- Corning Incorporated (U.S.)

- Donaldson Company, Inc. (U.S.)

Regional Landscape

- North America dominates the current market, holding ~40% share in 2023, with projected market share around 27–28% by 2025, supported by stringent regulations such as FDA or EPA compliance standards in pharmaceutical, chemical, and wastewater sectors.

- Europe also contributes 20% of the market, with growth driven by regulatory pressures such as REACH and environmental mandates.

Product Types & Segments

Hydrophobic vs Hydrophilic

- Hydrophobic PTFE membranes lead the market and are expected to grow fastest—with 63.1% share by 2025—because of their superior moisture resistance, making them ideal for pharmaceutical, biotech, and industrial applications.